Trading beyond technical analysis: The advantages of using volatility, entropy, probability and statistics

Maximize Profits and Minimize Risk: The Advantages of Trading with Volatility, Entropy, Probability, and Statistics

Introduction: The Importance of Volatility, Entropy, Probability and Statistics in Trading

Trading in financial markets is a challenging task that requires a deep understanding of market dynamics, as well as the ability to make accurate predictions about future price movements. In recent years, there has been a growing interest in using volatility, entropy, probability, and statistics as a means of making trading decisions, as opposed to relying on traditional technical analysis of price action.

Understanding Volatility and its Role in Financial Markets

One of the main reasons why it is safer and smarter to trade using volatility, entropy, probability, and statistics is that these methods take into account a wide range of market factors that can affect price movements. Technical analysis, on the other hand, is based solely on the historical price action of a given security and does not account for other factors that can impact prices. For example, a stock’s price may be affected by changes in interest rates, economic conditions, or even political events. By considering these factors, traders who use volatility, entropy, probability, and statistics are better equipped to make informed decisions about whether to buy or sell a particular security.

The Advantages of Using Entropy in Trading

Another advantage of using volatility, entropy, probability, and statistics is that these methods are based on solid mathematical principles. This means that traders can use them to make predictions about future price movements with a high degree of accuracy. Technical analysis, on the other hand, is often based on subjective interpretations of historical price data, which can lead to inconsistencies and errors in trading decisions.

The Importance of Probability and Statistics in Financial Markets

Furthermore, the use of volatility, entropy, probability, and statistics allows traders to quantify the risk associated with a particular trade. This information is critical in making informed trading decisions, as it enables traders to identify the potential losses that they may incur if a trade goes against them. Technical analysis, on the other hand, provides no information about the potential risk associated with a trade.

How to Incorporate Volatility, Entropy, Probability and Statistics in Your Trading Strategy

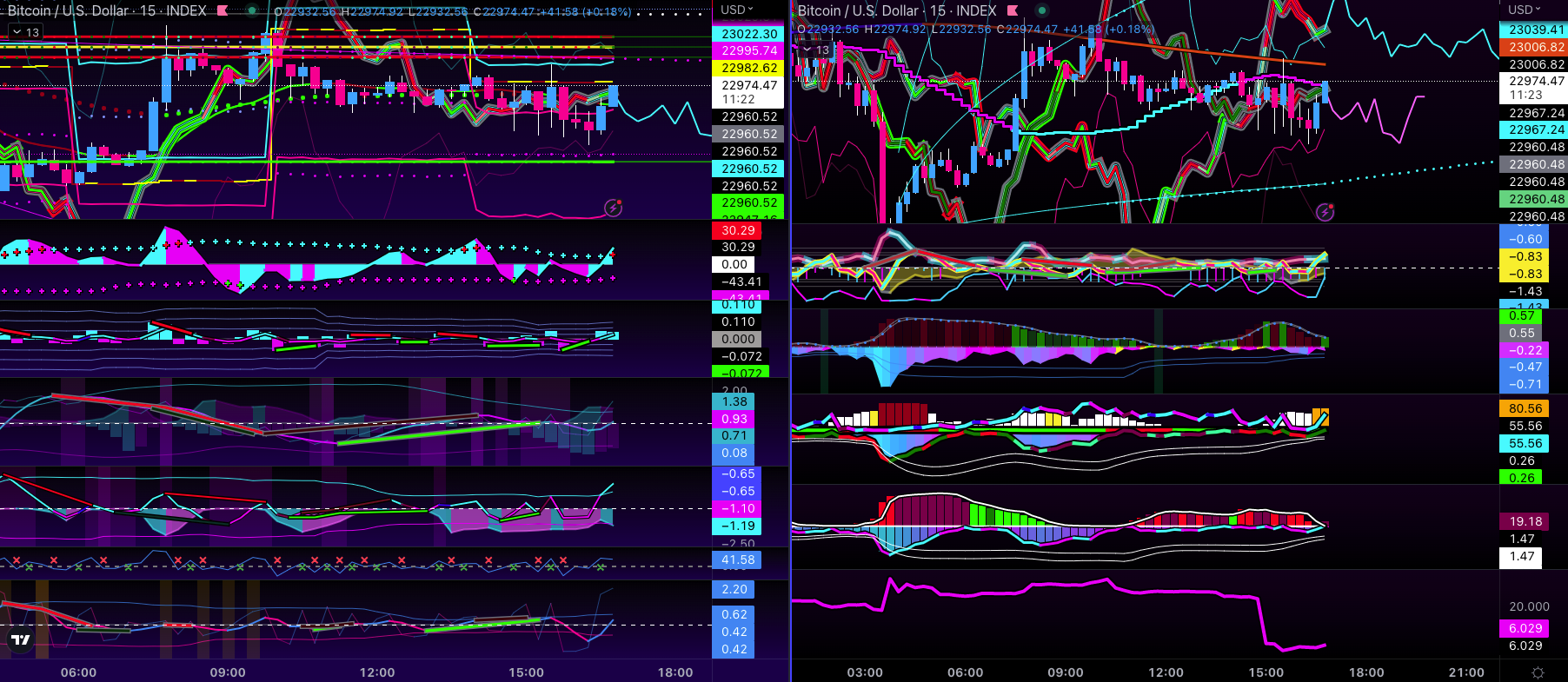

In addition, volatility, entropy, probability, and statistics allow traders to identify patterns and trends in the market that are not visible using traditional technical analysis methods. For example, by analyzing volatility data, traders can identify periods of high volatility, which may indicate that the market is about to experience a significant price movement. Similarly, by analyzing entropy data, traders can identify periods of a trending move or a random walk, which may indicate that the market is about to experience a period of consolidation.

Conclusion: The Future of Trading with Volatility, Entropy, Probability and Statistics

In conclusion, it is safer and smarter to trade using volatility, entropy, probability, and statistics rather than relying on traditional technical analysis of price action. This is because these methods take into account a wide range of market factors that can affect price movements, are based on solid mathematical principles, and allow traders to quantify the risk associated with a particular trade. Furthermore, the use of volatility, entropy, probability, and statistics enables traders to identify patterns and trends in the market that are not visible using traditional technical analysis methods.

Additional Resources for further learning about the topic.

https://AlphaTradingHQ.com/discord – Join the Alpha Trading Discord for more info and Subscribe to get all the tools and educational information!

https://youtube.com/@AlphaTradingVol – Subscribe to the Alpha Trading YouTube Channel for the latest VEPS market analysis videos, Live Streams and updates